As farmers wait nearly two years for promised second payment

By Angela Mtambo in Kasama

Fish farmers who applied for loans under the K440 million aquaculture seed fund, managed by the Citizens Economic Empowerment Commission (CEEC) through the Zambia Aquaculture Enterprise Development Project, are unlikely to receive the full amounts they requested.

The challenges faced by these farmers and other Zambian small business owners are further compounded by millions of kwachas in unpaid loans, systemic inefficiencies, administrative failures, and a poor repayment culture at CEEC.

The aquaculture fund at the CEEC, financed by the African Development Bank (AfDB) and managed by the Ministry of Fisheries and Livestock, was established to support fish farming businesses.

When contacted, the bank declined to address MakanDay’s questions directly.

“Thank you for the query. “However, given that the money belongs to the borrower who GRZ, kindly direct the query to the PS (Permanent Secretary) Ministry of Fisheries and Livestock who has all the transaction records,” the bank stated in an emailed response.

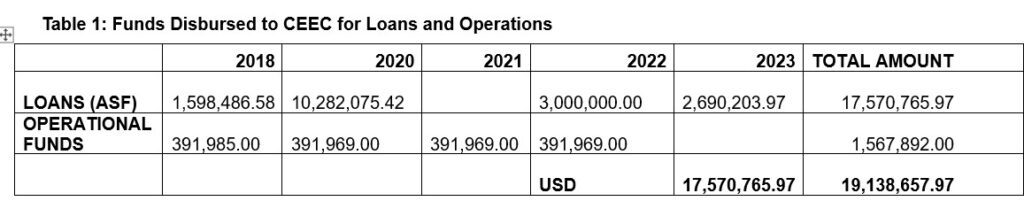

The Permanent Secretary confirmed that the bank had paid approximately US$ 19.1 million to CEEC. Of this, about US$ 17.6 million was allocated to loan recipients, while US$ 1.6 million was used for operational costs.

However, some farmers who received loans through the CEEC for their fish farming ventures reported receiving less than 10% of the approved loan amounts.

According to the CEEC’s 2018 annual report, the fund—implemented across 35 districts in all provinces, including Kasama—is meant to make each province self-sufficient in fingerling production and eliminate the national annual fish production deficit of 85,000 metric tonnes within four years.

The programme’s ultimate goal, according to CEEC, was to transform Zambia into a net exporter of fish and fish products within ten years.

It was described as “one of the most poverty-reducing development programmes in Zambia’s history,” enabling citizens to participate in the entire value chain, including fish production, feed supply, cold chain services, fish processing, marketing, and more.

No money for Kasama farmers

MakanDay’s investigation into a Kasama-based project has revealed how a promise “to eliminate the national annual fish production deficit of 85,000 metric tonnes” has turned into a nightmare for some farmers in northern Zambia.

In November 2022, CEEC approved a K167,000 loan for Justin Mutale, a fish farmer based in Kasama to boost his business. However, the commission’s failure to disburse the full amount has shattered his plans.

Mutale received only K15,400—less than 10% of the approved amount—over a year ago, leaving his fish farming business teetering on the brink of collapse.

The loan was to be paid from the K440 million aquaculture seed fund managed by CEEC under the Zambia Aquaculture Enterprise Development Project.

Without the necessary capital, Mutale’s aquaculture venture has been hit hard. The first amount he received was quickly exhausted on initial costs, leaving little for essential items such as fish feed. Without proper nutrition, the health of his fish has deteriorated, leading to smaller yields and lost income.

“I thought the loan would be a lifeline for my business, but I’ve been left in a worse position,” Mutale said. “I can’t sustain the farm with just K15, 000. I was depending on the full amount to buy the necessary equipment and feed for the fish.

To make up for the shortfall, Mutale turned to vegetable farming, growing crops to supplement the fish feed. However, this plan soon backfired when his irrigation system broke down. Without water, the vegetables dried up, and his attempt to salvage the situation failed.

“I tried everything I could to keep the farm going. When I couldn’t afford feed, I thought growing vegetables would help, but then the irrigation system failed, and my crops died,” Mutale explained.

Mutale’s predicament highlights a systemic issue affecting many small fish farmers who rely on loans from CEEC in northern Zambia.

The revolving nature of the fund means that entrepreneurs often receive funding in instalments, depending on repayments made by previous borrowers. However, for businesses that depend on timely financing, such delays can be crippling.

Ministry explains partial cash disbursement to farmers under loan Scheme

The Ministry of Fisheries has justified the decision to disburse only about 10% of the total loan amount in cash to farmers, citing concerns over the potential diversion of funds if beneficiaries were fully funded.

“This could justify why farmers only received about 10% cash of the total loan if they are fully funded,” said the Ministry in a statement. “For beneficiaries that are partially funded, CEEC is funding them through recoveries.”

The ministry elaborated that farmers received payments in two phases: the first payment of K12,000 was for pond construction under Phase 1, while the second payment was the balance after all suppliers were paid, provided as working capital.

“The model was designed that farmers will not be paid the money for inputs because in the previous project, other farmers diverted the money when they were paid for inputs, hence to hedge against this risk, suppliers were paid by CEEC to supply the inputs.”

The CEEC assured partially funded beneficiaries that they would continue receiving support through recovery mechanisms.

According to the Ministry of Fisheries, CEEC has recovered 64 percent of the loans issued, amounting to K44,726,259.81 out of a total due of K69,381,594.09.

Troubling trend

However, MakanDay’s investigation into these delays has uncovered a troubling twist. Some farmers have been waiting for over two years to receive the second payment, which was supposed to be disbursed as working capital.

Further complicating matters, a source within the CEEC office in Kasama disclosed that part of the funding from the African Development Bank was withheld due to concerns over the commission’s handling of aquaculture projects nationwide.

This revelation directly contradicts official explanations attributing the delays in loan payments to administrative procedures. The insider’s account raises serious concerns about CEEC’s management and accountability.

CEEC is a government agency established by the Citizens Economic Empowerment Act No. 9 of 2006, under the Ministry of Small and Medium Enterprises Development. CEEC’s mandate is to promote economic empowerment for citizens, citizen-influenced companies, citizen-empowered companies, and citizen-owned companies through various socio-economic strategies.

The Ministry of Small and Medium Enterprises Development defends the revolving fund model, arguing that it broadens access to loans over time. However, the National Assembly’s Committee on Parastatal Bodies has flagged significant shortcomings in CEEC’s management of the fund. The committee’s report reveals that CEEC fails to enforce its credit policy effectively, leading to a poor loan recovery rate and over K30.2 million in arrears under the aquaculture seed fund alone.

The committee’s review of CEEC’s financial records for the year ending December 31, 2021, revealed several irregularities, including a poor repayment culture, insufficient resources for monitoring and supporting borrowers, and ongoing challenges in loan recovery.

The committee expressed alarm at the discovery that over K283 million (K283,198,666) is tied up in non-performing loans, with some debts remaining unpaid for up to 14 years.

A crisis of confidence

Further investigation by MakanDay reveals that Mutale’s case is not unique. Another fish farmer, speaking on condition of anonymity, recounted a similar ordeal. Although he applied for K167,000, he received only K15,200 in 2022. With the limited funds, he managed to dig fish ponds but has made little progress since.

In October, staff from the CEEC head office in Lusaka visited Kasama to conduct reviews. However, the outcome and next steps remain unclear. When contacted, CEEC confirmed the visit but couldn’t clarify whether Mutale was included in the inquiry.

Mutale, however, denied being visited by CEEC officials, raising concerns about the effectiveness of the inquiry. This development highlights a pattern of inconsistencies in CEEC’s disbursement and follow-up processes. Multiple fish farmers have received inadequate funding, and transparency around the program’s progress appears lacking.

Discover more from MAKANDAY

Subscribe to get the latest posts sent to your email.