In a bustling city like Lusaka, where numerous banks abound, the closure of a bank due to insolvency might not grab headlines. However, for a quaint rural town like Luangwa in Eastern Province, the shuttering of Investrust Bank due to insolvency sent shockwaves through the community.

When Investrust closed its doors, it left a significant void in the area as the sole banking institution. Consequently, a filling station that had been banking with Investrust ceased supplying fuel to the locals. Additionally, women’s clubs expecting funding from the Constituency Development Fund (CDF) through the bank had to postpone their plans indefinitely.

The Bank of Zambia’s decision to assume control of the bank on April 2, 2024, due to insolvency underscored the vulnerabilities associated with relying solely on one financial institution.

This action was in accordance with Section 64 of the Banking and Financial Services Act No. 7 of 2017, which permits the BOZ to “take supervisory action against a financial service provider where… the financial service provider fails to comply with this Act and any rule or regulatory statement issued in accordance with this Act or any other applicable law”.

In a statement, the Bank explained that the takeover was necessitated by the bank’s insolvency.

“The Bank of Zambia has had numerous engagements with the shareholders to recapitalise the bank. Unfortunately, the shareholders have been unable to resolve the insolvency. Under the circumstances, the Bank of Zambia has had to exercise its authority under the law to safeguard financial stability and the interests of the public,” the statement read.

Luangwa: The sleepy isolated town

Located in the eastern part of Zambia, Luangwa district sits at the confluence of the Luangwa and Zambezi Rivers, huddled within the Zambezi Escarpment, a region that stretches through the Lower Zambezi National Park. Historically known as Feira, meaning ‘marketplace,’ this area is renowned for its bustling fish trade, a vital source of income for many locals. Yet, it also grapples with significant human-wildlife conflicts.

A MakanDay journalist visiting the district to assess the impact of the bank’s closure found that one of the only two fueling stations had shut down. The owners of the station could not risk keeping large sums of money from fuel sales at home.

“Even if we manage to procure fuel, the pressing concern remains: where can we safely deposit the money?” asked Rubis fueling station manager Robert Nsofu. “Mobile money booths here lack the necessary floats for our deposits.”

Additionally, he said, “Currently, we are at a standstill until a new bank is established or viable alternatives emerge for money transfer, as transporting such cash poses significant risks to our safety and security.”

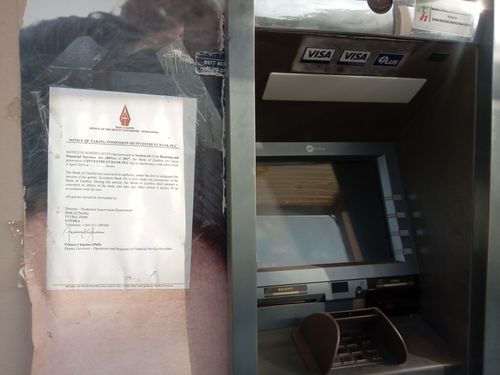

At the council lodge, commonly known as Feira Lodge, Investrust rented the annex building of the lodge to operate as its branch in Luangwa. The abandoned building is now adorned with notices of the bank’s closure posted at the entrance and the automated teller machine (ATM) area.

This lodge is conveniently located opposite the harbour, where the fish trade occurs. Fish from this harbour is distributed in bulk to various parts of the country, particularly to the Kasumbalesa border, which Zambia shares with the Democratic Republic of Congo.

Derrick Kashinamilunda, the Constituency Development Fund (CDF) chairperson for Luangwa Constituency, explained that prior to the closure, several clubs and cooperatives had pending withdrawals for various projects approved by the committee.

With the bank’s closure, these projects have been put on hold, leaving them in limbo awaiting further guidance.

Kashinamilunda, who is also a church pastor, added that his church ministry had also been impacted, unable to proceed with wiring the church building since all the funds were held in an Investrust account.

The cry of a woman

Esnart Tembo, a member of the Chimange Chilimbe Tailoring and Designing Women’s Club, said her club, along with 80 other women’s clubs in the district, cannot access their grants secured from the CDF.

Tembo told MakanDay that their club had applied for a CDF grant amounting to K25,000 to enhance their tailoring business. Additionally, they had secured a tender at a private school within the district to produce school uniforms worth K2,000.

However, their plans were disrupted when the bank closed just one day after the CDF grants were deposited into their account. She mentioned that approximately 82 clubs in the district had applied for CDF grants.

“After the bank was closed, the school decided to assign the contract to another organisation, citing uncertainty regarding when we would receive the funds,” she said.

Additionally, Rosemary Tembo, a member of the Luangwa Christian Brethren Women’s Multipurpose Cooperative, said the bank closed just before they could collect their grant.

“Our cooperative comprises 21 women, and we were very hopeful about receiving the grant to kick-start our business. We envisioned a future where our chicken sales would empower us as women within the group. Now, our dreams are shattered because of the bank closure, and we are uncertain about the next steps forward,” she explained.

The District Commissioner

Luangwa District Commissioner Luke Chikani observed that the absence of a bank in the district threatens to derail ongoing progress in the district.

“There has been remarkable development in our district through the CDF, especially since the government increased the allocation to 30.6 million. Numerous projects across various sectors such as education and health have been initiated. It’s worth noting that every government department in the district was affiliated with Investrust, the bank that facilitated these developments,” he explained.

One of the officials interviewed is Mainda Mudenda, the Director of Engineering at Luangwa Council. He revealed that some of the projects he supervises have been affected as he and his team are unable to monitor them effectively due to insufficient funds.

“Given our current financial constraints, we are facing challenges in effectively monitoring our projects. Consequently, our pace has slowed down significantly. It’s crucial for us to maintain regular project monitoring to prevent contractors from veering off track, as rectifying their errors can prove costly for the council,” he said.

Gradually coming back to life

While the BoZ has made some funds available for depositors to access their money held up in the bank, the move doesn’t fully resolve the situation in Luangwa, where there was only one bank.

BoZ Governor Denny Kalyalya explained that they will facilitate the initial payment to all depositors, up to a maximum of K500,000, covering over 90 percent of the total deposit accounts.

As of April 27, depositors in Luangwa had also started receiving payments through Investrust, while Indo Zambia Bank, Access Bank, and Zanaco have moved in to establish a presence in the district.

Discover more from MAKANDAY

Subscribe to get the latest posts sent to your email.